WASHINGTON DC, Jan 29 (IPS) – As 2024 begins, the excellent news is that there haven’t been any notable requests by a low-income nation for complete debt reduction since Ghana’s, greater than a 12 months in the past. Regardless of this, vulnerabilities stay, with excessive debt servicing prices a rising problem for low-income international locations.

Financing pressures as a result of comparatively excessive curiosity funds and the tempo at which low-income international locations have to repay debt are straining budgets. That forestalls these international locations from spending extra on important providers or the vital funding wanted to draw enterprise, create jobs, enhance prosperity, and construct local weather resilience.

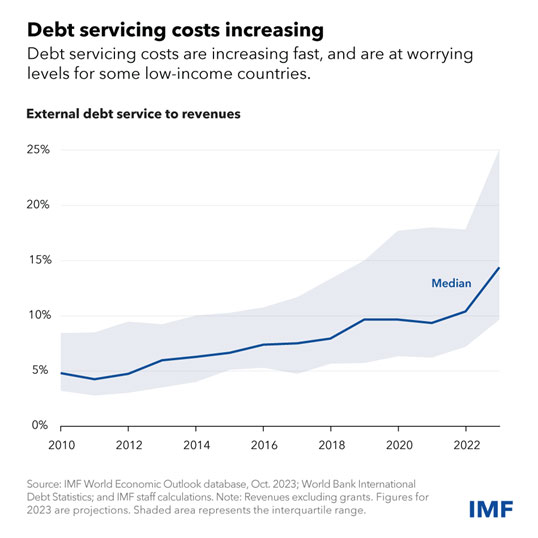

One essential metric is the share of revenues the federal government collects from its inhabitants by means of taxes and different charges that goes to pay its international collectors. Whereas the dimensions of the burden differs significantly throughout international locations, it’s usually about two and a half occasions increased than a decade earlier.

This implies for a typical low-income borrower the share has risen to about 14 p.c, from about 6 p.c, and as a lot as 25 p.c, from about 9 p.c in some economies. This is likely one of the key indicators used within the framework for assessing debt sustainability that alerts a rustic may be susceptible to needing monetary help from the IMF or of lacking a debt cost.

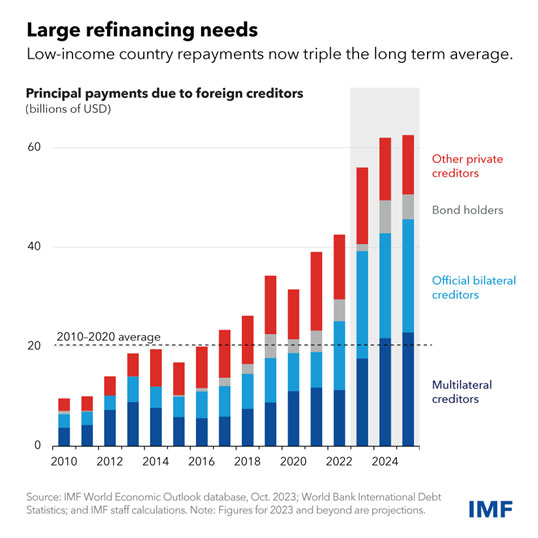

Low-income international locations even have vital debt repayments falling due within the subsequent two years. They should refinance about $60 billion of exterior debt annually, about 3 times the typical within the decade by means of 2020.

However with many competing calls for for financing, together with from superior and rising market economies which might be additionally making an attempt to adapt to local weather change, there’s a big danger of a liquidity crunch—failure to boost enough financing at an reasonably priced price. That might in flip result in a destabilizing debt disaster.

To deal with this financing problem, we should perceive why it’s occurring and what affected international locations and the broader worldwide neighborhood can do to assist.

Exacerbating liquidity squeeze

One issue was increased authorities borrowing and deficits to mitigate the affect of the pandemic and different exterior financial shocks. This has elevated the extent of debt and consequently the price of servicing it. It’s encouraging that this development is reversing as international locations carry major deficits again in step with pre-pandemic ranges.

As well as, central banks have considerably raised borrowing prices to tame inflation. That makes it costlier for governments to boost new debt or refinance current debt. Whereas central banks could also be performed elevating charges, it isn’t clear when they’ll begin to reduce, and this uncertainty could also be mirrored in risky monetary market situations.

Low-income international locations have additionally more and more borrowed from the personal sector—with about one third of financing coming from personal collectors within the final decade in contrast with about one fifth within the earlier decade.

This mirrored a slowdown in financing from multilateral growth banks (MDBs) within the earlier a part of the last decade and thru official growth help (ODA) companies over 2020-22 in comparison with borrowing wants. This shift has elevated each financing prices and vulnerability to international monetary shocks.

Avoiding a expensive debt disaster

Constructing resilience within the face of those traits requires international locations to behave. Some international locations have made progress— for instance, Angola,The Gambia, Nigeria, and Zambia have taken steps to implement vital vitality subsidy reforms to create house for growth spending.

However many are lagging behind, particularly in efforts to extend revenues, reminiscent of broadening the tax base, lowering tax exemptions, and rising the effectivity of tax administration.

As an illustration, the standard Sub-Saharan African nation raised solely 13 percent of gross home product in revenues in 2022, in contrast with 18 p.c in different rising economies and creating international locations and 27 p.c in superior economies.

And people with excessive debt vulnerabilities can’t afford to attend. Coverage reforms are wanted to spice up development and seize extra income from that development, as an illustration, by means of tax reforms. This may immediately enhance international locations’ key debt metrics and guarantee they will keep away from a expensive debt disaster.

Nevertheless, reforms take time to ship outcomes, so international locations also needs to proactively work on mobilizing funding at decrease prices, specifically grants. For some, this may imply turning to the IMF for assist.

That is certainly certainly one of our key roles—serving to international locations bridge a financing hole whereas working with them to strengthen their coverage frameworks. Different companions, notably MDBs or suppliers of ODA, may additionally be keen to increase financing, particularly to help reforms that assist tackle international challenges reminiscent of local weather.

And official collectors face their very own limitations. Efforts to make sure the IMF has enough assets to fulfill our members’ wants, along with efforts to scale-up MDB help, are vital. In the identical vein, efforts to guard ODA budgets will make sure the least lucky have the chance to take part extra totally within the international financial system.

Extra systemic options wanted?

It’s not but clear whether or not country-driven actions and scaled-up multilateral monetary help will probably be enough to handle these challenges, however some analysts have begun questioning whether or not a extra systemic strategy to reprofiling or refinancing debt is required.

Low-income international locations can already search debt reduction by means of the Group of Twenty’s Common Framework, together with to scale back their speedy debt servicing burden. Up to now the Widespread Framework has solely been used to assist international locations scale back the extent of debt (aside from the debt standstill agreed for Ethiopia).

However it was additionally meant to offer extra non permanent liquidity reduction. Nevertheless, to be efficient in that function would require higher predictability and velocity. There was progress—the settlement on a debt remedy by official collectors for Ghana took lower than half the time it took for Chad two years earlier—however continued engagement on technical points, together with by means of the Global Sovereign Debt Roundtable (established final 12 months by the IMF, World Financial institution and G20), is essential.

Total, the funding squeeze dealing with low-income international locations should be carefully monitored. A situation the place enough low-cost funding materializes is feasible, however there are additionally situations the place extra formidable reforms, stronger worldwide cooperation, and quicker enhancements within the international debt restructuring structure could also be vital to assist them emerge stronger and extra resilient.

Chuku Chuku, Neil Shenai and Madi Sarsenbayev contributed to this submit.

Supply Worldwide Financial Fund (IMF)

IPS UN Bureau

Follow @IPSNewsUNBureau

Follow IPS News UN Bureau on Instagram

© Inter Press Service (2024) — All Rights ReservedOriginal source: Inter Press Service