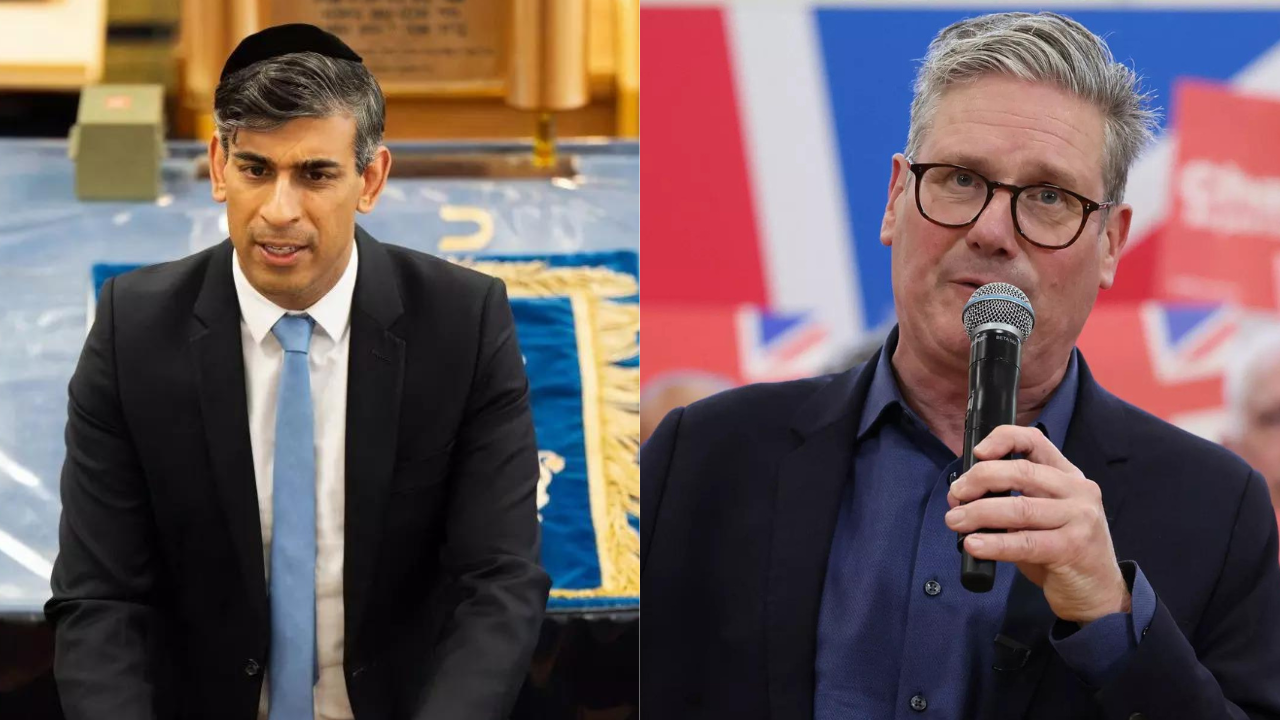

Because the votes are being tallied, early indications recommend that Labour has taken a commanding lead, doubtlessly setting the stage for a change within the nation’s political panorama.

Credit standing companies that downgraded the UK’s score after Brexit and the market turmoil attributable to Liz Truss in 2022 have raised a number of considerations that require consideration from the new authorities.

Excessive debt-to-GDP ratio

One main subject is the UK’s excessive debt-to-GDP ratio, which is near 100%. Whereas all events have pledged to enhance public companies and put money into infrastructure with out rising key taxes, the market response to Truss’s spending plans serves as a cautionary story towards radical measures. S&P World highlighted the significance of balancing income and expenditure changes to enhance the underlying fiscal place.

Financial development challenges

One other concern is the UK’s sluggish financial development, averaging simply 1.6% yearly over the previous decade. Fitch Scores, which raised its outlook on the UK’s AA- score to “secure” in March, notes that the nation’s debt-to-GDP ratio is greater than double the median for ‘AA’ bracket international locations. Boosting development shall be difficult resulting from elements akin to internet migration, labour market participation, and productiveness development points.

Fiscal guidelines and debt administration

The brand new authorities can even want to contemplate whether or not to switch the UK’s self-imposed fiscal guidelines, which mandate a discount in public sector debt as a share of GDP over a five-year interval. Whereas some Labour officers have urged that important reforms are at the moment off the desk, the federal government faces substantial debt issuance and curiosity funds within the coming years.

Pound as a international reserve foreign money

Scope, a European-based score agency, highlights the significance of sustaining the pound’s standing as a worldwide reserve foreign money. “A secure authorities managing credible budgetary insurance policies” and “enhancing entry to the (EU) Single Market” are seen as key elements in preserving this standing.

Sewage disaster

Lastly, the problem of uncooked sewage discharge by privatised water corporations has turn into a distinguished election subject. If these corporations fail to put money into fixing the issue, the federal government could have to intervene and run them, including to the UK’s debt burden. Whereas this alone is probably not sufficient to alter the UK’s score, it might contribute to a confluence of things that would impression the nation’s credit score evaluation.

(With Reuters inputs)