China’s financial system stumbled within the second quarter, official information exhibits, simply because the nation’s prime leaders gathered for a key assembly to handle its sluggish development.

It grew 4.7% within the three months to June, falling wanting expectations after a stronger start in the first three months of 2024. The federal government’s annual development goal is round 5%.

“China’s financial system hit the brakes within the June quarter,” mentioned Heron Lim at Moody’s Analytics, including that analysts are hoping for options from the assembly beneath approach in Beijing, additionally referred to as the Third Plenum.

The world’s second-largest financial system is going through a protracted property disaster, steep native authorities debt, weak consumption and excessive unemployment.

Previous outcomes of the Plenum have modified the course of historical past in China – in 1978, then chief Deng Xiaoping started opening China’s markets to the world, and in 2013 Xi Jinping hinted at loosening the controversial one-child coverage.

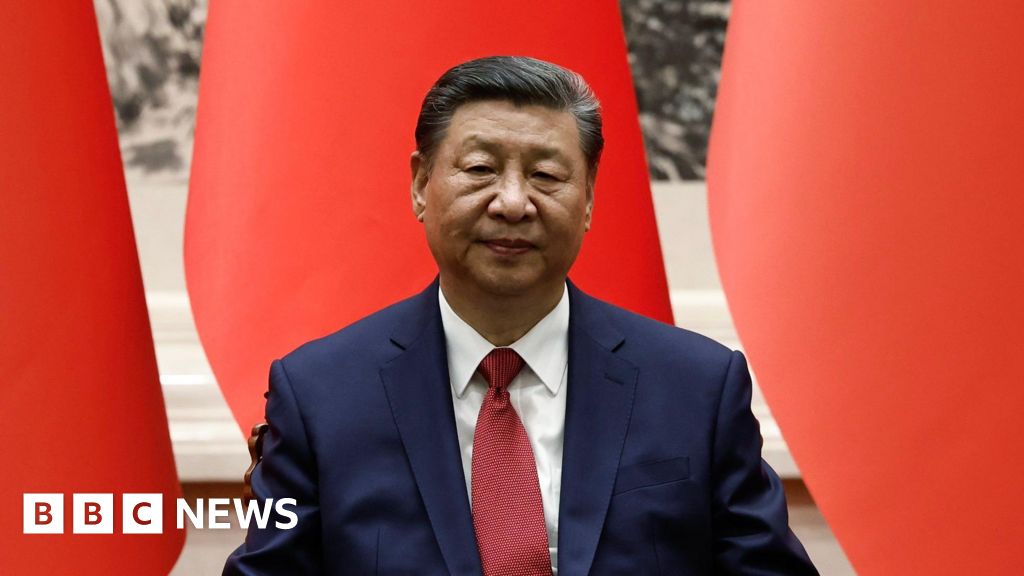

And so there are expectations of this yr’s Plenum, the place President Xi Jinping is presiding over a closed-door gathering of 370-plus high-ranking Chinese language Communist Social gathering members.

The rhetoric on state-controlled media has actually been encouraging.

An editorial in The World Occasions mentioned a “wide selection of reform-focused polices” are “excessive on the agenda” and would usher in a “new chapter”. Xinhua referred to “complete” and “unprecedented” reforms. The editorial within the Individuals’s Every day was headlined on a “new period of reform and opening up”, invoking the very phrase Deng coined in 1978.

Observers, nevertheless, are uncertain of how a lot room there’s for daring concepts or debate within the Social gathering beneath Mr Xi’s heavily-centralised management. Some see the assembly as a mere rubber-stamping train for selections which have already been made.

Economists are additionally sceptical the assembly will ship a fast repair.

It has “little affect on near-term development,” says Qian Wang, Asia Pacific chief economist at Vanguard, as a result of its focus can be on longer-term and extra important reforms to “unleash the long-term development potential”.

Nonetheless, analysts can be awaiting bulletins that sign the Social gathering’s financial priorities.

Separate information on Monday confirmed that costs for brand spanking new houses in June fell on the quickest tempo in 9 years.

That is extra proof of the disaster that has engulfed China’s property sector and led to the demise of giants similar to Evergrande. The worry is that it might unfold to different components of the financial system.

“There are greater than 4,000 banks in China and over 90% are smaller, regional banks that are extremely uncovered to the housing market and native authorities debt,” says Shanghai-based economist Dan Wang.

She believes Social gathering leaders will “push for consolidation of small banks”.

One other challenge is falling costs – a symptom of weak demand. Retail gross sales in June grew by simply 2%, which is under expectations and an indication that customers are nonetheless cautious about spending and unsure of the longer term.

“A significant concern is the lack of family, enterprise, and investor confidence within the authorities’s skill to navigate the perilous financial setting,” mentioned Eswar Prasad, former head of the Worldwide Financial Fund’s China division.

Nonetheless, questions stay about Beijing’s willingness to ship the type of resolution that may satisy observers and the markets.

“The federal government is reluctant to show to short-term stimulus plans similar to money switch to households,” Dan Wang mentioned. “As a substitute, we count on them to emphasize as soon as once more on bolstering provide chains and excessive tech.”

That’s consistent with Beijing’s bets on high-tech industries similar to renewable vitality, AI and chip-making, and exports to revive the financial system. Final month, China reported a file commerce surplus – $99bn (£76.4bn) – as exports soared and imports struggled.

However even that wager is faces challening odds. Main buying and selling companions such because the European Union and the USA have imposed tariffs and different boundaries on items made in China, from EVs to superior chips.