Getty Photos

Getty PhotosTypically referred to as “white gold” and the important thing element in rechargeable batteries, the metallic lithium is so gentle that it floats on water, however its worth has sunk like a stone over the previous yr.

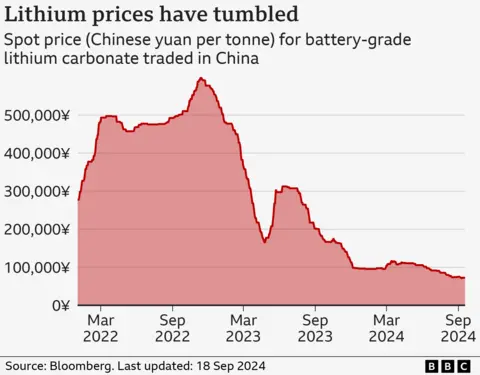

As a result of a mixture of falling global sales of electrical autos, and a world oversupply of lithium ore, the price of the principle lithium compound has fallen by greater than three quarters since June 2023.

This decline has had a very laborious influence on Australia, as a result of it’s the world’s largest producer of lithium ore, accounting for 52% of the global total final yr.

Australia additionally has the second-largest reserves of the mineral after Chile, with the overwhelming majority in Western Australia, and a smaller quantity within the Northern Territory.

The sharp decline in lithium costs has led to mine shutdowns. Adelaide-based Core Lithium introduced again in January that as a consequence of “weak market situations” it was suspending mining at its Finniss web site close to Darwin, with the lack of 150 jobs.

Then in August, US agency Albemarle stated it might be scaling again manufacturing at its Kemerton lithium processing plant, positioned some 170km (100 miles) south of Perth. That is anticipated to result in greater than 300 redundancies.

Arcadium Lithium adopted go well with this month, asserting that it might be mothballing its Mt Cattlin mine in Western Australia, blaming low costs. The agency’s shares are listed in each the US and Australia.

But as some producers are placing work on maintain, others are increasing theirs, assured that international demand for lithium – and costs – will bounce again.

Pilbara Minerals is one such agency. The Perth-based miner goals to spice up its lithium ore manufacturing by an extra 50% over the subsequent yr.

“What we have realized traditionally from lithium pricing is that it could change, and it could change quickly,” managing director Dale Henderson just lately instructed ABC Information. “It would not faze us that a lot as a result of we all know the long-term outlook is improbable.”

This confidence is echoed by Kingsley Jones, founder, and chief funding officer at Canberra-based funding agency Jevons International, which screens the mining and metals sectors. “Lithium stays very strategic to the vitality transition,” he tells the BBC.

“Storage batteries for electrical energy is an enormous progress space,” he provides, pointing to the elevated want for batteries to retailer the facility generated by photo voltaic and wind energy.

However some analysts have warned that oversupply will maintain the market underneath stress till at the least 2028.

Getty Photos

Getty PhotosOne other firm shifting forward with elevated lithium ore manufacturing in Australia is Perth-based Liontown Sources. In July, it began manufacturing at its Kathleen Valley mine, positioned 420 miles (680km) north-east of Western Australia’s capital.

The power will get 60% of its vitality from its personal photo voltaic panel farm.

Australia’s Minister for Local weather Change and Power, Chris Bowen, has praised the positioning’s inexperienced strategy, and his authorities has invested $A230m ($156m; £118m) within the facility.

This transfer in the direction of the usage of renewables can be excellent news in monetary phrases for producers in Australia, because it reduces their dependence on shopping for costly diesel, which is at the moment the principle gas that they use to generate electrical energy.

Extracting lithium ore within the nation requires 3 times extra vitality than in different large producing nations corresponding to Chile and Argentina, says Prof Rick Valenta, the director of the Sustainable Minerals Institute on the College of Queensland.

Extraction in Australia requires further vitality as a result of the lithium ore, also called spodumene, must be mined and faraway from strong rock. Whereas in Chile and Argentina the ore is produced by evaporating it from brine collected from underneath the nations’ huge salt plains.

“As Australia has hard-rock mining operations, they use extra vitality and produce extra emissions than brine operations,” Prof Valenta provides.

The type of lithium that Australia exports – virtually all of which goes to China – is partially processed ore, referred to as spodumene focus.

Costs of this have mirrored the sharp fall of refined lithium. One report this month stated that the worth of spodumene had hit its lowest level since August 2021.

Chinese language corporations refine the spodumene into strong lithium, and into the 2 lithium compounds utilized in batteries – lithium hydroxide and lithium carbonate.

That is the place the actual cash is to be made, as a result of a tonne of lithium carbonate is at the moment round 72,500 yuan ($10,280; £7,720) in contrast with simply $747 (£630) for a similar weight of spodumene focus.

Provided that worth differential, Australian mining corporations have unsurprisingly been shifting to build their own lithium refineries as an alternative of simply exporting virtually all spodumene, as is the case at the moment. In 2022-23, 98% was exported as spodumene focus.

Kingsley Jones

Kingsley JonesThe primary refined lithium to be commercially produced in Australia occurred again in 2022, when Perth-based IGO introduced that it was making battery-grade lithium hydroxide at its Kwinana Refinery in Western Australia. It co-owns the ability with Chinese language agency Tianqi Lithium.

In the meantime, one other Australian miner, Covalent Lithium, is building its own lithium refinery, additionally in Western Australia. And Albemarle has its refinery, albeit one at the moment lowering its output.

Some commentators welcome the event of lithium refining in Australia, saying it is going to assist to reduce China’s dominance of the worldwide marketplace for the metallic. China at the moment accounts for 60% of all lithium refining.

Nevertheless, Kingsley Jones says that Australia must be extra open to embracing Chinese language funding within the lithium sector. He factors out that the Australian authorities has, in his view, “adopted a method, we expect unwisely, to choice funding from nations apart from China” within the lithium sector lately.

This has come as relations between the 2 nations have cooled since 2020. Final yr, Canberra even blocked the sale of an Australian lithium miner to a Chinese language agency.

The federal government stated on the time that it was merely following the recommendation of the nation’s Overseas Funding Evaluate Board.

Mr Jones provides: “It’s a wonderful instance of find out how to shoot your self within the foot as a producer. You inform the largest purchaser to go away. So, they do.”

Australia’s Division of Trade, Science and Sources didn’t reply to a request for a remark.

As Australia goals to turn out to be extra of a lithium refiner, authorities scientists are persevering with to analysis methods to do that in a extra environmentally pleasant method. A code, which if cracked, may make the nation one of many greenest producers of the metallic. Presently the method releases loads of toxic chlorine gasoline.

“There is just one industrial methodology, and it has a number of drawbacks,” says Dongmei Liu, a analysis scientist at Australia’s nationwide science company, the CSIRO.

“The method could be very costly and never very environment friendly. Most significantly, it additionally produces chlorine gasoline. It has extreme environmental points.”

She and her staff are as an alternative engaged on a new process referred to as “shock quenching”. It entails the acute cooling of lithium vapour, and Dr Lui says it “avoids the chlorine gasoline emissions”.

Dongmei Liu

Dongmei LiuWhereas Australia hopes to make its mineral industries much less polluting, it additionally desires to recycle extra.

Lithium Australia is a listed firm that types and processes batteries which have come to the top of their lives, to extract their lithium and different metals for reuse.

“International commodities costs place financial stress on lithium, so making a round battery trade will profit Australia by making certain now we have the sovereign functionality to supply and recycle our personal batteries,” says Lithium Australia chief government Simon Linge.

“If Australia is to determine a battery manufacturing trade, we should first be certain that no end-of-life lithium battery is being despatched to landfill or exported to be recycled in another nation.”