However most analysts say the Individuals’s Financial institution of China (PBOC) will keep on with conventional instruments relatively than resorting to large liquidity injections by way of “quantitative easing” (QE), as some main economies reminiscent of Japan and america have executed.

Market expectations stay excessive for extra stimulus to spice up the world’s second-largest financial system, which is displaying tentative indicators of momentum regardless of a long-running debt disaster within the property sector, which used to account for 1 / 4 of China’s gross home product.

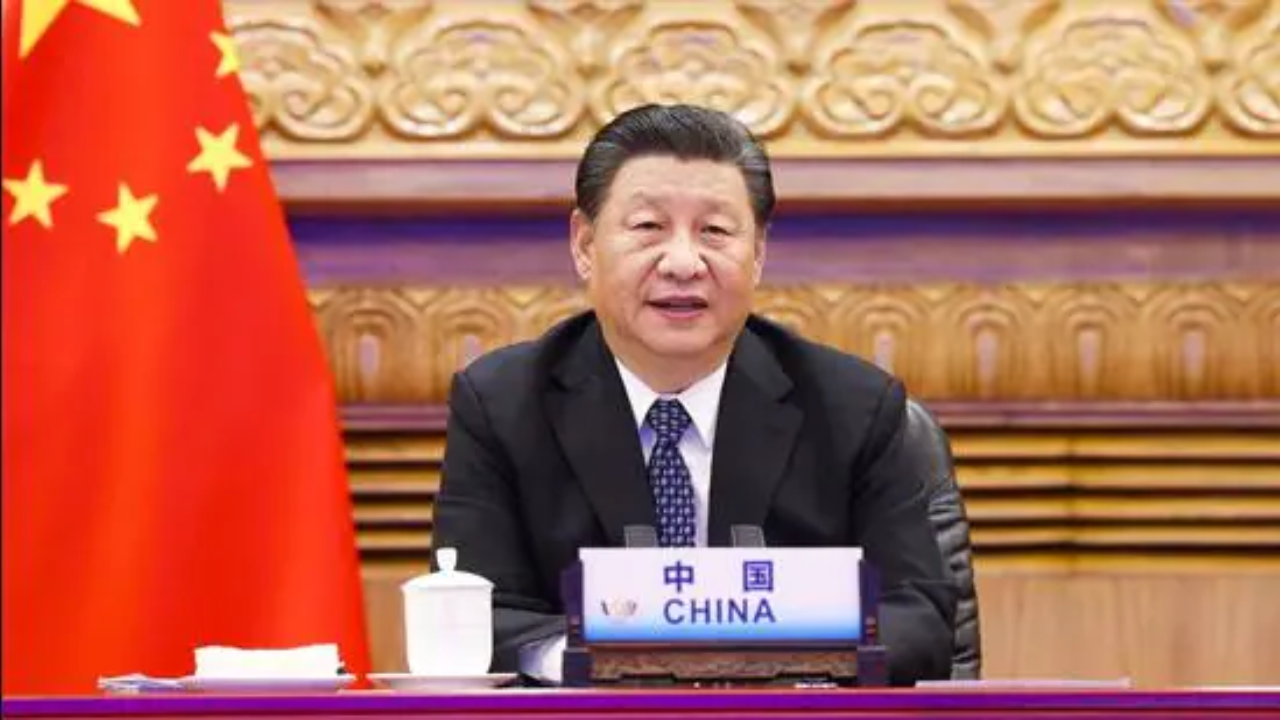

“The Individuals’s Financial institution of China should slowly enhance the buying and selling of treasury bonds in its open market operations,” Xi informed a serious monetary assembly in October in a speech that was not printed on the time however was included in a e book this month.

The Hong Kong-based South China Morning Publish cited an excerpt of the speech on Thursday from the e book, triggering market speak about the way to interpret Xi’s phrases in opposition to the backdrop of the PBOC’s reluctance to flood the system with liquidity as a result of fears of inflation and asset bubbles.

China’s blue-chip inventory index bounced 0.5% off one-month lows on Thursday. On Friday, 10-year treasury bond futures rose essentially the most in three weeks.

The hypothesis additionally displays investor sensitivity to feedback made by Xi, China’s president for 11 years and its strongest ruler since Mao Zedong.

The PBOC didn’t instantly reply to a request for remark.

LIQUIDITY AMPLE, ROOM TO CUT RATES

Xi’s speech was “not shopping for authorities bonds within the major market, subsequently not a sign of QE”, mentioned Morgan Stanley’s chief China economist, Robin Xing.

“In reality, in the identical speech, Beijing made hawkish feedback that the deleveraging course of requires a tighter grip on cash and credit score provide, which we consider signifies continued choice for austerity to forestall misallocations,” Xing mentioned in a word to traders.

The PBOC is just not allowed to purchase bonds straight from the central authorities. It final purchased them within the secondary market in 2007.

Xi was “calling for replenishing the central financial institution’s financial coverage toolkit”, together with increasing its choices in open-market buying and selling of presidency bonds to handle liquidity, mentioned Tao Wang, head of Asia economics and chief China economist at UBS Funding Financial institution.

Guolian Securities economist Rocky Fan mentioned the PBOC may purchase treasury bonds whereas decreasing reverse repurchases, changing one with the opposite.

Amongst different conventional coverage instruments, PBOC Deputy Governor Xuan Changneng mentioned final week that slicing industrial banks’ reserve requirement ratios, now averaging round 7% after a 50-basis-point lower in January, can be an vital approach to inject liquidity.

Final month, the PBOC lower its five-year mortgage prime price by 25 foundation factors to three.95%, essentially the most because the reference price was launched in 2019.

The PBOC final lower the speed on one-year medium-term lending facility loans, a information to the mortgage prime price, by 15 foundation factors to 2.50% in August.

“(Different) central banks are doing QE as a result of their coverage charges are near zero they usually cannot lower any additional, however the PBOC nonetheless has room to chop its coverage price, which is now 2.5%,” Macquarie economists wrote in a word.

China is concentrating on 3.9 trillion yuan ($540 billion) in native authorities particular bond issuance this 12 months to help the financial system, up from 3.8 trillion yuan final 12 months, and 1 trillion yuan in particular ultra-long time period treasury bonds to assist key sectors.

Reflecting excessive demand for bonds and the ample liquidity within the monetary system, China’s 30-year treasuries yield round 2.47%, close to this month’s report low of two.442%.

“Whether or not you take a look at cash provide or the extent of rates of interest, the diploma of financial easing we have skilled has not often been seen in historical past,” mentioned Xia Chun, chief economist at Forthright Holdings.